- Oil Pipeline

- Water Pipeline

- Gas Pipeline

- Boat and Mooring Accessories

- Metal for Decoration

- Transformer Components

- Heat Exchanger Pipe

- Air Conditioning Spare Parts & Accessories

- Boiler

- Kitchen and Bathroom Appliance

- Metal for Household Appliance

- Solar Power Appliance

- Elevator

- Roofing and Ceiling

- Cable

- Tank

- Packaging

- Machinery and Equipment Spare Parts & Accessories

- Mold

- Automobile Parts

- Rail and Crane Rail

- Hardware Fitting

- Abrasive

- Road Construction Equipment

- Electronic Components

- Construction and Decoration Materials

- Doors and Windows

- Refrigerators

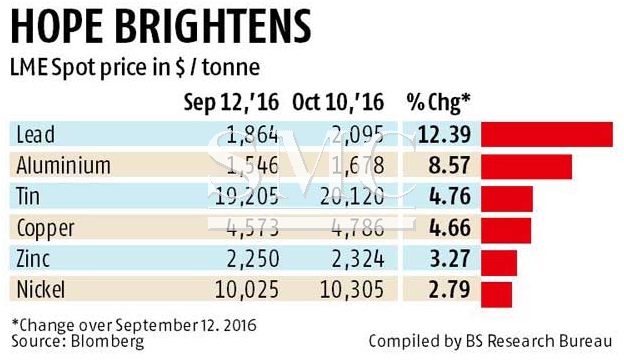

The future looks bright for Base Metals

Base metals are likely to remain resistant for the foreseeable future, the revival comes amid expectation that demand from the user industry and consumption levels are expected to outpace

those of supply in 2017, after a number of the world’s major suppliers announced they would be cutting production levels. After a sharp decline, non-ferrous metals led by lead jumped by up

to 12.39 per cent in the past month following hopes for a pick-up in industrial activities the world over. Delay in the interest rate upward revision by the US Federal Reserve’s has also supported

base metals by a large extent. Copper, meanwhile, remained resilient.

“Copper price is likely to remain range-bound in the short term ranging between $4,800 and $5,000 a tonne on the London Metal Exchange (LME) with an upward bias for medium- to long-term

to $5,500 a tonne,” said P Ramnath, chief executive officer of Sterlite Copper, a Vedanta Group company.

Analysts, however, believe that the supply deficit forecast by the International Copper Study Group (ICSG) for 2016 and 2017 on production cut announced by major global producers would support

copper price to move upwards. In its latest monthly release, ICSG forecast the refined copper production deficit of around 306,000 tonnes for the first half of 2016 compared to a deficit of 227,000

tonnes for the comparative period last year. This means, the deficit is widening with expectations of aggravating further in future.